how are rsus taxed in canada

RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from 10 to 37 depending on the recipients household income. Taxes at RSU Vesting When You Take Ownership of Stock Grants.

The taxation of RSUs is a bit simpler than for standard restricted stock plans.

. When the RSUs vest when youre able to sell them youll receive a taxable benefit equal to the value of the shares received or cash. If you sell your RSUs on vest date. The year of receipt equal to the value of the RSUs or PSUs.

The day your RSUs vest you will be taxed on them as regular income. RSUs are taxed at ordinary income rates when issued typically after vesting. When granted RSU is taxed as income.

If the RSUs or PSUs are settled in cash and within the three-year period you will have a full income inclusion in. 613-751-6674 Chantal Baril Tel. What you do when they vest will determineif capital gains comes into play.

When vested the price difference is taxed as capital gain which count as 50 income. RSUs are treated like income as they should be. Growth after they vest will be taxed like capital gains half your marginal rate.

If RSUs are settled in cash or can be settled in cash or shares. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. Canadas top marginal rate is 53.

If you keep them for more than a year youll be subject to the more favorable. RSUs are effectively deferred employee bonuses. In this post we will look at how RSUs are taxed for Canadian residents.

If you are awarded RSUs each unit represents one share of stock that you will be given when the units vest. Generally tax at vesting for RSU. When your restricted stock units vest and you actually take ownership of the shares two dates that almost always.

For example your marginal tax rate is 30. Taxable amount is fair market value of the shares on the tax event. Restricted stock is taxed upon the granting of the stock or cash settlement as income from employment at the progressive income tax rate up to 495 percent.

Also restricted stock units are. How Are Restricted Stock Units RSUs Taxed. Youll be taxed at the short-term capital gains tax rate if you keep your shares for less than a year.

Because there is no actual stock issued at grant no Section 83 b election is permitted. This is different from incentive stock. Ordinary Income Tax.

Heres the tax summary for RSUs. Canadian Tax Legal Alert CRA issues new views on RSU taxation in Canada April 21 2021 Contacts. Restricted Stock Units are simply a promise to issue stock at some future vesting.

Capital gains tax is imposed only if the stockholder.

Rsa Vs Rsu Everything You Need To Know Global Shares

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Canada Taxation Of International Executives Kpmg Global

Tax Insights Canada Revenue Agency S Hybrid Sourcing Methodology For Restricted Stock Units Pwc Canada

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Ca Hybrid Methodology For Sourcing Certain Rsus Kpmg Global

Amazon Stock Rsu Global Agreement Pdf Pdf Vesting Withholding Tax

Pro Tips 4 Tax Return Errors To Avoid With Stock Options Rsus And Stock Sales

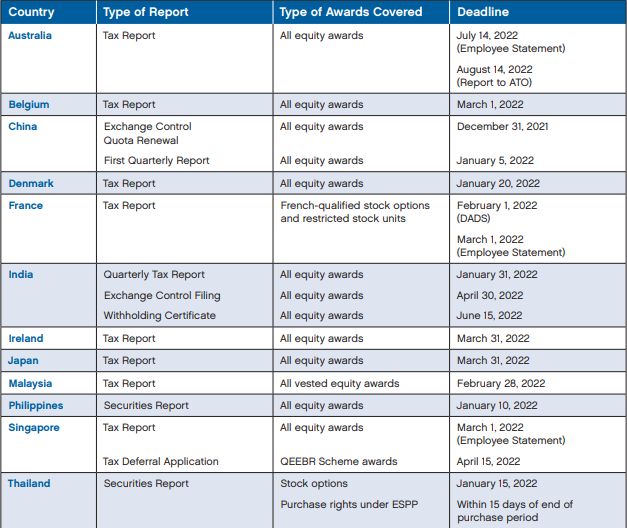

Employee Stock Plans International Reporting Requirements Employee Rights Labour Relations Worldwide

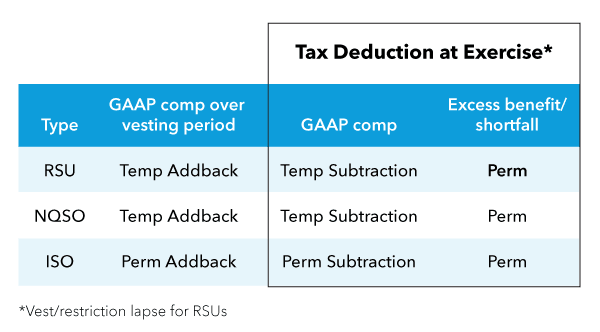

Asc 740 Stock Based Compensation Bloomberg Tax

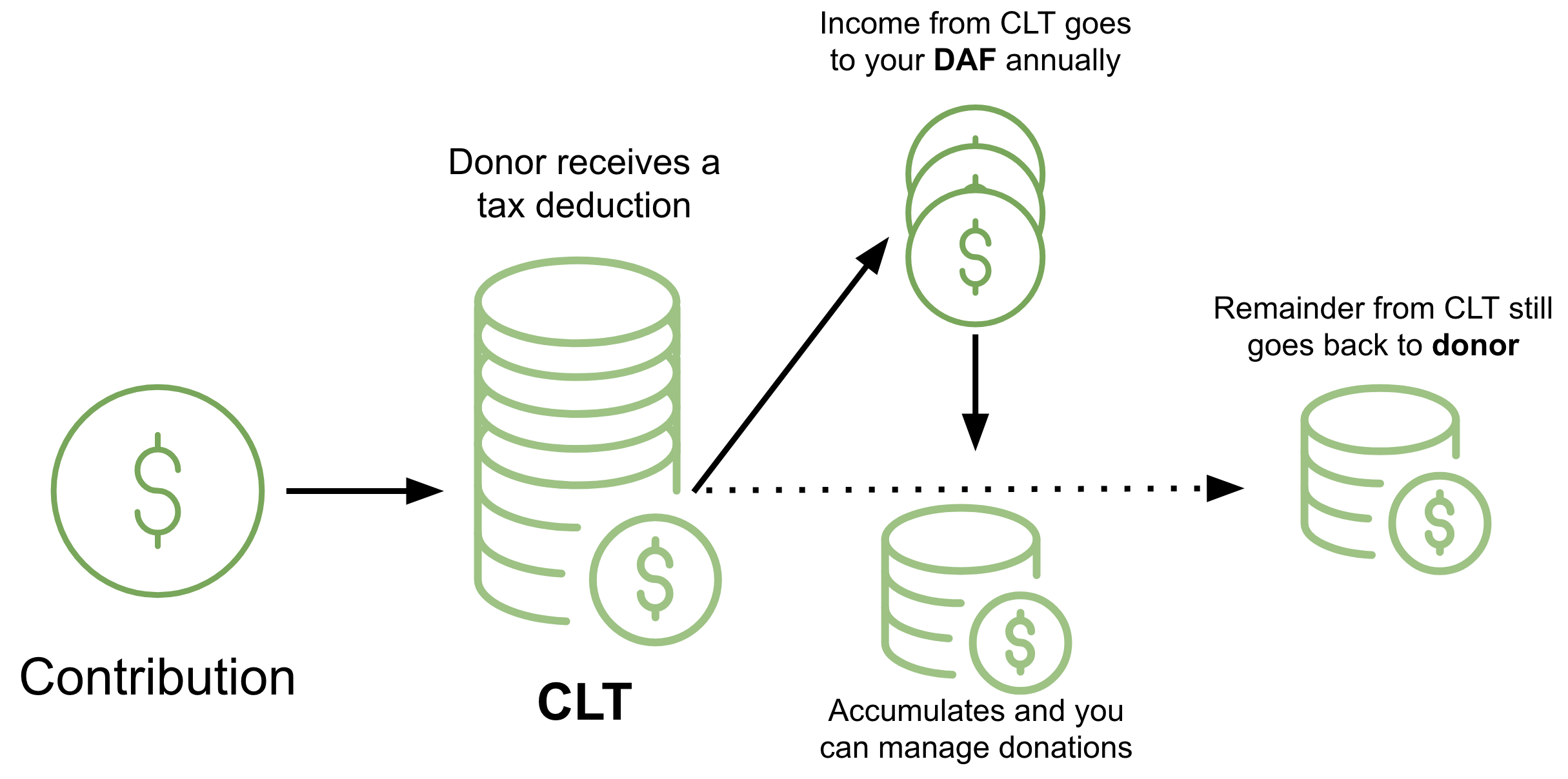

How To Avoid Taxes On Rsus Equity Ftw

What Is A Rsu Restricted Stock Unit Carta

Restricted Stock Units Jane Financial

Restricted Stock Units 10 Fast Facts Newsletters Legal News Employee Benefits Insights Foley Lardner Llp

Tax Treatment Of Restricted Stock Unit Rsu Benefits Canadian Capitalist