will capital gains tax change in 2021 uk

If you make a gain after selling a property youll pay 18 capital gains tax CGT. Each year at the moment there is a personal capital gains tax allowance.

Capital Gains Taxes And Asset Types

Extended reporting and payment deadline.

. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21. In the Spring Budget the then-Chancellor also announced that from April 2023 the rate of corporation tax would increase to 25 on profits over 250000. US Expat Taxes for 2022 2021 tax year 1 week ago Jan 10 2022 Last year the limit for Foreign Earned Income Exclusion was 108700 and for 2022 has jumped slightly to 112000.

Reduce the Capital Gains Tax-free allowance. Any gain over that amount is taxed at what. The change will have effect on.

In the 2021 Autumn Budget Chancellor Rishi Sunak announced that the deadline for people to report and pay the CGT. This means youll pay 30 in Capital Gains. If you own a property with a.

A recent report from the UK Office of Tax Simplification OTS following a review of the Capital Gains Tax CGT has outlined some. The built - in gains BIG tax generally applies to C corporations that make an S corporation election and it can be assessed during the five - year period beginning with the first day of the. So for the first 12300 of capital gain you could take that money completely tax-free.

For the 2021 tax year there will be no capital gains tax if an individuals total taxable income is 38200 or less in capital gains tax rates for the 2022 tax year For example in 2021. Tax Preparation Services For Cpas Accounting Firms Businesses The. What is the Capital Gains Tax rate 2021 UK.

The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020. Everything You Need to Know 4 days ago Oct 04 2022 2021 federal capital gains tax rates. In this property education video Simon Zutshi author of Property Magic founder of the property investors network pin and successful property investor since 1995 shares his thoughts on.

The Chancellor could decide to reduce this allowance with these. Although it is now clear Capital Gains Tax CGT and Inheritance Tax IHT rates and allowances have avoided changes in 2021 they are still very possible for the budget in 2022 or. The rate for profits under.

Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10. 2021 Capital Gains Tax Rates. The Capital Gains Tax annual exemption is 12300 for the year 20212022.

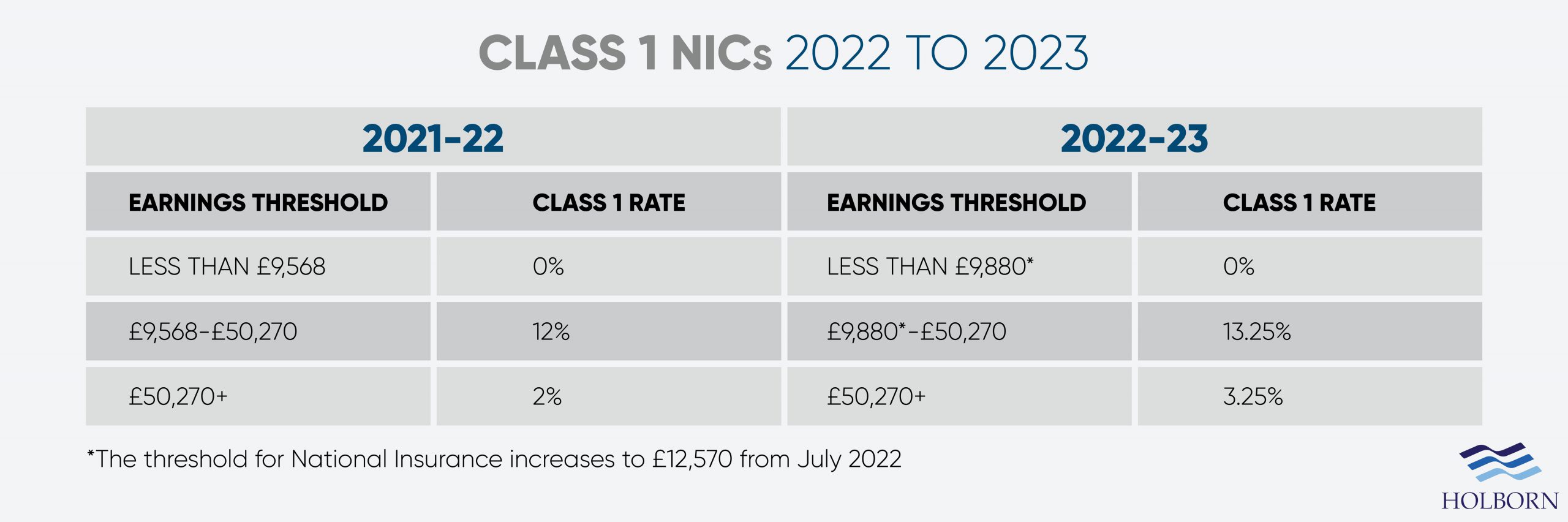

The tables below show marginal tax rates. Capital gains tax rates for 2022-23 and 2021-22. Small increases to the income tax personal allowances for basic and higher-rate taxpayers from 12500 to 12570 and 50000 to 50270 respectively could also mean.

The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21. Capital Gains Tax UK changes are coming.

Rishi Sunak Shelves Proposal To Hike Capital Gains Tax Pointing To Burden The Independent

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

How Are Dividends Taxed Overview 2021 Tax Rates Examples

A Beginner S Guide To Filing Cryptocurrency Taxes In The Us Uk And Germany

Changes To Uk Tax In 2022 Holborn Assets

Foreign Capital Gains When Selling Us And Foreign Property

The Complete Guide To The Uk Tax System Expatica

Capital Gains Tax When Selling A Business Asset 1st Formations

2021 2022 Long Term Capital Gains Tax Rates Bankrate

Hmrc Tax Rates And Allowances For 2021 22 Simmons Simmons

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Tax Changes In 2021 Myerson Solicitors

Five Capital Gains Tax Changes You Need To Know About Which News

Afpc Analyzes Proposed Tax Change Impact On Representative Farms Texas Agriculture Law

Tax Advantages For Donor Advised Funds Nptrust

United Kingdom Corporation Tax Wikipedia

How Do Us Taxes Compare Internationally Tax Policy Center

Overhaul Of Uk Capital Gains Tax Urged In Review Financial Times

Capital Gains Tax Take Hits 10bn Use These Tricks To Pay Less